This year, many firms—but not all—are bullish.

- Russell Investments is predicting that the Russell 1000 Index will climb approximately 5.8% this year

- Goldman Sachs says the S&P 500 may climb 12%.

- U.S. Trust is calling for the S&P to climb 14%

Many forecasts are based on expectations that corporations will continue to grow their earnings despite sluggish economic expansion in the U.S., continuing concerns over the nation’s quickly growing debt burden, the euro-zone debt crisis, and European austerity limiting economic growth.

Yet not everyone is bullish regarding equities.

Gluskin Sheff + Associates Chief Economist & Strategist David Rosenberg believes equity markets will be flat this year, a result of deleveraging by consumers and the U.S. government and other economic challenges. He recommends that investors maintain conservative portfolios and thinks commodity investments, such as U.S. forestlands, may be a good hedge against monetary policies that are fueling currency devaluation.

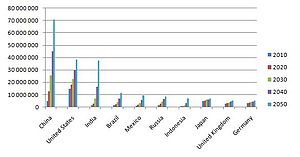

Most forecasters, meanwhile, are providing a mixed outlook for emerging markets, although many expect China’s economy to experience a soft landing followed by improving growth, with urbanization driving demand for housing, appliances, furnishings and other trappings associated with living in a developed economy.

Like with any decision, a long menu of options can only complicate matters. For advisors, the abundance of conflicting forecasts is no different and sorting through market commentaries can be a time consuming task.

For some firms, the task of analyzing market outlooks is handled by investment committees that can summarize reports or find common themes that may be helpful for influencing portfolio management decisions. Investment committees can therefore be helpful for separating important information from market noise, or reactionary and emotionally driven ideas.

The challenge of sorting through a large number of reports, of course, doesn’t detract from the value of forecasts. Rather, advisors can glean helpful insights from the quickly growing pool of market data and predications that are readily available.

For example, advisors may want to make portfolios slightly more defensive when sentiment is predominantly bearish. However, they should keep in mind, of course, that sentiment and market forecasts, while often calling overall markets directions correctly, are frequently inaccurate.

Indeed, for 2012, many forecasters took an overly bearish stance because they put too much emphasis on the potential impact of the euro-zone crisis and U.S. fiscal policy. In reality, accommodative monetary policy helped fuel strong equity gains. Unfortunately, advisors and portfolio managers who followed sentiment during the year and established overly defensive portfolios missed out on strong U.S. equity gains. The lesson, perhaps, is that using investor sentiment when building portfolios is a delicate balance of taking prudent measures to manage risk while continuing to pursue attractive investment opportunities.

For many advisors, the conflicting nature of investment forecasts simply underscores the importance of maintaining long-term, strategic asset allocations that reflect clients’ unique investment time horizon, risk tolerance and savings goals. Rather than respond to sentiment by making drastic tactical asset allocations, many advisors may instead use sentiment to fine tune how they manage risk. For example, rather than simply increase exposure to fixed-income securities when sentiment is bullish, advisors may increase their portfolios’ exposure to alternative assets, such as funds that take both short and long positions to manage market volatility and ensure their portfolios have sufficient diversification.

Advisors, of course, aren’t the only investors who follow market outlooks, which are readily available to the general public. Indeed, advisors’ clients may often be familiar with market outlooks from leading investment firms. With that in mind, advisors may want to be familiar with market outlooks in case their clients bring up the topic in discussions.